Bengaluru, February 7: On a regular February morning, amid the usual churn of reels and lifestyle clips, one video cut through the noise. It was not flashy. It was not aspirational. It was a quiet accounting of survival.

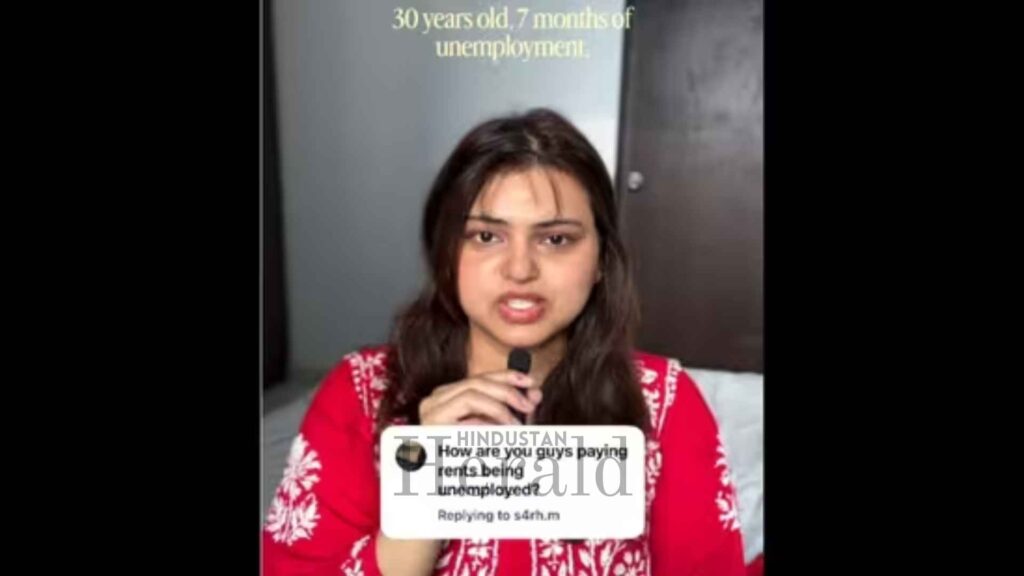

A 30-year-old unemployed woman, Nikita, who posts on Instagram under the handle @social_coded, shared a plainspoken breakdown of her January 2026 expenses in Bengaluru. Near the end of the list came the line that set off a firestorm. She had borrowed ₹30,000 from her mother after spending seven months without a job.

By evening, the clip had gone viral. By night, it had turned into a referendum on money, privilege, unemployment, adulthood, and what it really costs to stay afloat in India’s tech capital.

A Month Of Numbers That Felt Uncomfortably Familiar

Nikita’s video does not dramatise her situation. She simply reads through the figures.

Her rent stands at ₹13,000, a number that surprised many viewers who live in pricier neighbourhoods of the city. Food costs add up to ₹8,402, covering groceries and eating out. Transport and miscellaneous spending touch ₹4,284. Around ₹5,000 goes into healthcare and self-care, including grooming and wellness services.

There are smaller line items that caught disproportionate attention. ₹1,398 on shopping, ₹1,331 on movies and outings, and ₹800 spent on an astrology app, which she openly admits she regretted. She also mentions continuing a ₹2,000 SIP investment, even while unemployed.

Then comes the disclosure that lingered longest. To make the month work, she borrowed ₹30,000 from her mother.

According to Hindustan Times, Nikita currently relies on parental support, emergency savings, and occasional LinkedIn consulting work. None of it has yet translated into a stable role.

Why The Internet Reacted So Sharply

The reaction was immediate and deeply split.

Some viewers recognised themselves in the video. They spoke about layoffs, stalled careers, and the quiet stress of pretending everything is fine while burning through savings. Others appreciated the honesty, calling it a rare glimpse into the parts of city life that never make it into polished reels.

Still, the criticism was loud.

Why spend on facials and massages when you are unemployed? Why eat out? Why invest when you are borrowing money? And perhaps the sharpest question of all, how many people can fall back on a parent willing and able to lend ₹30,000?

What might have remained a personal budgeting post quickly became a proxy debate about urban privilege. The word surfaced repeatedly in comment sections, sometimes thoughtfully, sometimes as a blunt accusation.

The Unspoken Safety Nets Of Urban India

Bengaluru has long sold itself as a city of opportunity. It remains one. But it is also a city where gaps between jobs can stretch uncomfortably long, especially after the turbulence of recent years in the startup and technology sectors.

Nikita’s story resonates because it reflects a reality many quietly live. Adult independence in Indian cities is often conditional. Parents remain financial anchors well into their children’s thirties, especially when careers wobble. That support is rarely acknowledged publicly, and even more rarely interrogated.

For those without it, the numbers hit differently. There is no buffer. No borrowed month. No margin for error.

That said, financial planners have urged restraint in judging individual choices. Continuing an SIP may be misguided or it may be a long-term habit hard to abandon. Spending on self-care during unemployment can be indulgence or it can be mental health preservation. Context matters, and social media rarely provides enough of it.

When Vulnerability Becomes Content

There is also the question of the platform. Posting on Instagram turns private struggles into public performance, whether intended or not. Expense breakdowns have become a genre, often framed as productivity or self-improvement. What made Nikita’s video different was its refusal to resolve neatly.

There is no redemption arc yet. No announcement of a new job. No lesson neatly wrapped at the end.

As it turns out, that unresolved tension is what unsettled viewers the most.

A Mirror, Not A Moral Lesson

By the next day, Nikita had not posted any clarification or response. The conversation continued without her. It stretched into discussions about millennial finances, family dependence, and the fragile line between coping and collapsing in India’s most expensive cities.

For now, her January expense list remains what it always was. Not a manifesto. Not a plea. Just a ledger.

But in a city where success is loudly displayed and failure is carefully hidden, that quiet honesty struck a nerve. It forced many to confront truths they would rather scroll past.

Stay ahead with Hindustan Herald — bringing you trusted news, sharp analysis, and stories that matter across Politics, Business, Technology, Sports, Entertainment, Lifestyle, and more.

Connect with us on Facebook, Instagram, X (Twitter), LinkedIn, YouTube, and join our Telegram community @hindustanherald for real-time updates.

Covers Indian politics, governance, and policy developments with over a decade of experience in political reporting.